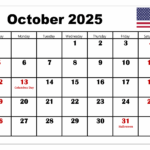

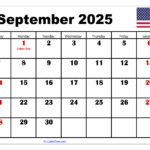

As we approach September 2025, it’s essential to stay on top of your tax obligations. With the Tax Calendar September 2025 just around the corner, it’s time to make sure you have everything in order.

Whether you’re a business owner or an individual taxpayer, staying organized with your taxes is key. This includes keeping track of important deadlines, such as filing dates and payment due dates, to avoid any penalties or interest charges.

Tax Calendar September 2025

Tax Calendar September 2025

One important date to remember is September 15, 2025, which is the deadline for estimated tax payments for the third quarter. Make sure you calculate your estimated tax liability accurately to avoid underpayment penalties.

Another key date is September 30, 2025, which is the deadline for businesses to file their quarterly federal excise tax returns. Make sure you have all the necessary documentation ready to submit on time.

For individual taxpayers, September 15 is also the deadline to file for a tax extension if you need more time to prepare your return. Remember, an extension to file is not an extension to pay, so make sure to estimate and pay any taxes owed by the original due date.

As September 2025 approaches, take the time to review your finances and ensure you’re prepared for the upcoming tax deadlines. By staying organized and proactive, you can navigate the tax season smoothly and avoid any last-minute stress or surprises.

Kalender Dan Agenda Untuk Pencetakan September 2025 A4 A3 Ke PDF Dan PNG 7calendar

Kalender September 2025 Siap Cetak Vektor Templat Untuk Unduh Gratis Di Pngtree

September 2025 Calendar Templates For PDF Excel And Word

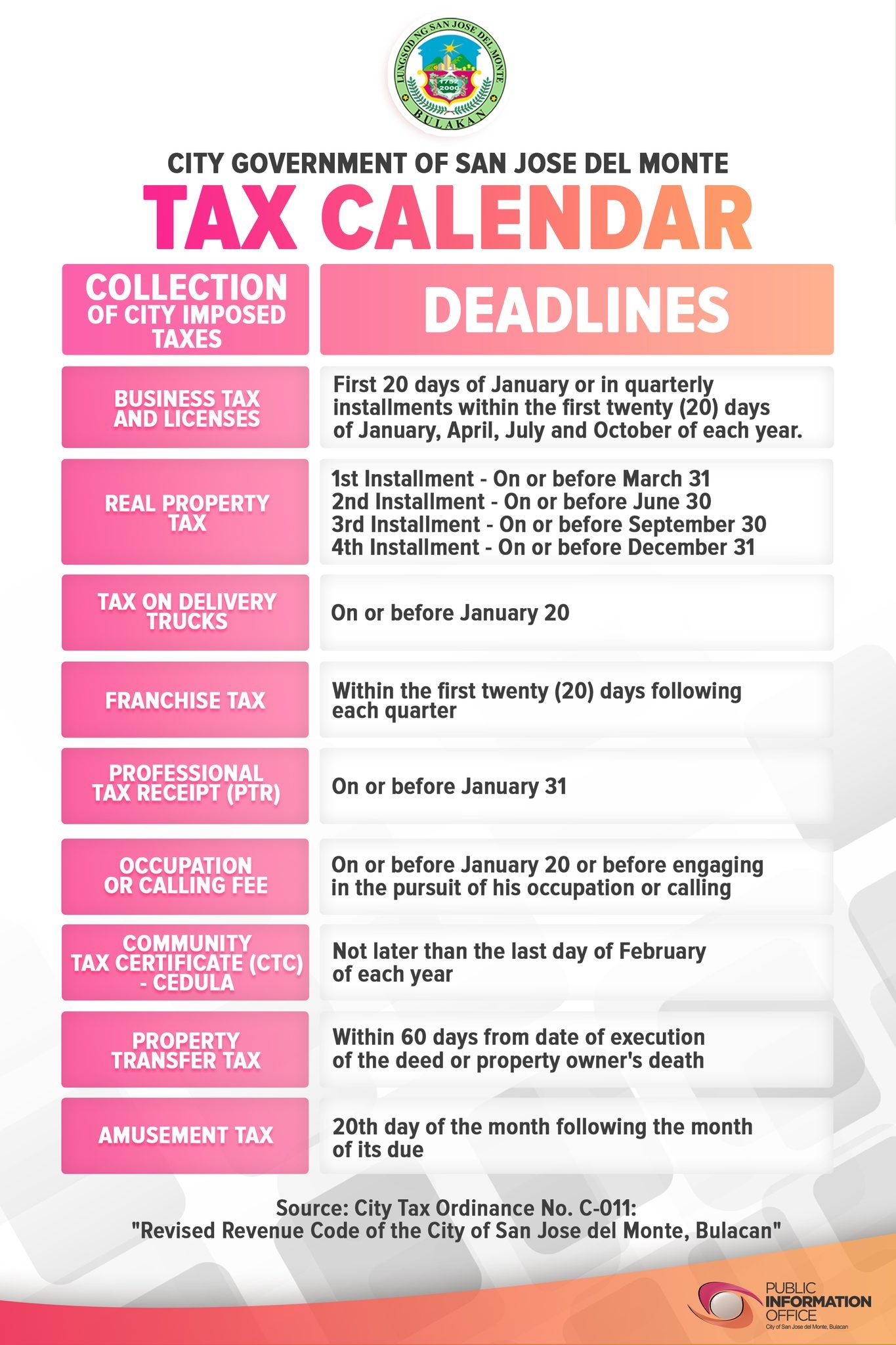

September 2025 Tax Calendar

TAX CALENDAR 2025 City Of San Jose Del Monte